Over the course of the last few years, HNF Property Commercial Agency Team have been successful in improving tenant occupation in shops that we let and/or manage and this has had a dramatic effect on the value of the assets concerned, increasing their value by as much as fifty per cent.

Back in the 1990s, it was the battles between Blockbuster and Ritz Video. As the decade grew on, it was the large corporate estate agents and companies such as Prudential and Lloyds Bank that entered the market. Paddy Power and William Hill competed as betting shops sought to get a foothold and more recently, it has been coffee shops and food retailing outlets, particularly supermarkets’ little brother, the convenience store.

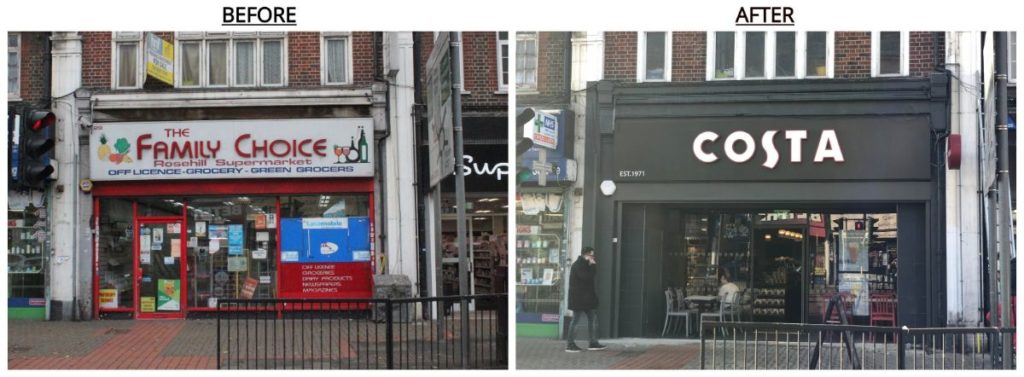

Both the increases in rent and the greater value that is attributed to a PLC covenant (reducing the yield that an investor would require) can create a significant increase in the capital value of a unit.

Those competing and with deep pockets, often pay higher rents than it is typical in a local suburban location and their strength of covenant reduces risk and increases capital value further as a result.

In the past you would not have found a Dentist nor a Solicitor in the High Street. Few would have bet on a Nail Bar or Dog Groomer occupying retail space and nobody could have envisaged uses such as Vape shops or Escape rooms.

So, the High Street is changing but is not dead and understanding grass root trends can generate occupancy, enhance and increase rents and, in turn, drive up value in otherwise difficult to let buildings, and locations.

Over the many years that we have operated in suburban commercial agency, trends have come and gone. Being so close to the market and immersed in it, enables us to give our landlords an opportunity to take an advantage when a new use operator seeks to establish itself on the High Street.

HNF Property has been operating in the London and the South East for over 25 years recognising these trends and applying that knowledge to the benefit our clients.

Please contact Jay Ward or Peter Friend on 0208 681 2000, if you require assistance with any commercial property matter.