HNF Property are pleased to announce that they are now undertaking surveys of both residential and commercial properties on behalf of clients.

PROBLEM HOUSE

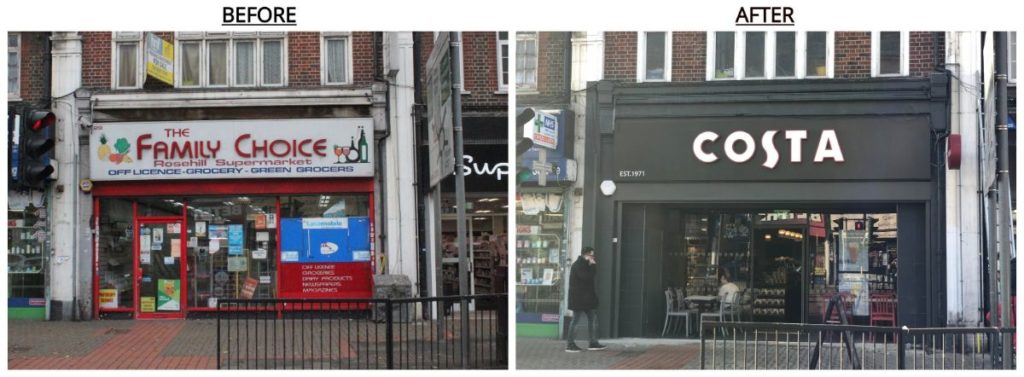

SHOP AS VACATED BY TENANT

On residential property, we are now not only able to undertake a valuation but we can provide Type 1 and Type 2 Homebuyers’ Reports, Structural Surveys and reports on individual defects, if required.

For commercial clients, we can also undertake Structural Surveys and, in addition, we are now able to prepare Schedules of Condition and can prepare and negotiate on Schedules of Dilapidations. Reports and schedules can be prepared independently or as part of an overall negotiation from instruction to settlement.

Our reports provide straightforward no-nonsense advice dependent on the type of Survey chosen reports can be accompanied by photographic evidence enabling the client to see and easily understand our findings and advice.

Tailored to the specific purpose and client, reports can incorporate rental valuation, capital valuation and advice on lease terms, liabilities, etc.

For further information and fee quotes, contact J A Naylor MRICS on 020 8766 0123.